Here is your annual reminder that August is National Make-A-Will month. Even if your estate planning documents are already in place, this is still a good time to review your will, trust, and beneficiary designations to ensure that they still capture your financial and family situation, as well as your intentions.

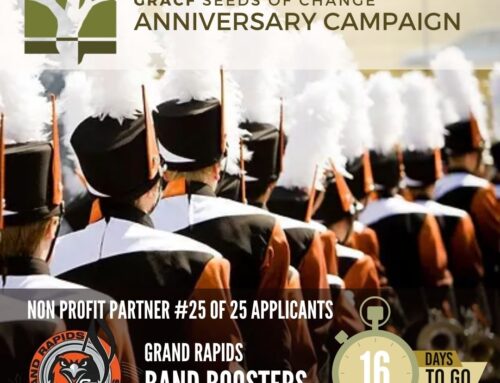

There are three good reasons to finally write your will. The number one reason is that it is an important legal document that everyone should have. It lets you distribute your property how you would like and protect your loved ones in the process. Second, it provides peace of mind to you and your family. And last, it could help you create a legacy that lasts beyond your lifetime. You can continue to make an impact by donating to a nonprofit organization in your will. Grand Rapids Area Community Foundation can help you manage your long-term legacy.

You may already have a fund at the Grand Rapids Area Community Foundation, and that fund can be an ideal recipient of estate gifts through a will or trust, or through a beneficiary designation on a qualified retirement plan or life insurance policy. Bequests of qualified retirement plans–such as your IRA–can be extremely tax-efficient. This is because charitable organizations such as the Community Foundation are tax-exempt. This means the funds flowing directly to a fund at the Community Foundation from a retirement plan after your death will not be reduced by income tax. This also means the assets will not be subject to estate tax.

You can contact the Grand Rapids Area Community Foundation at 218-999-9100 to find local nonprofit organizations with funds held at the Community Foundation, or you can do a search on the website gracf.org and click on Donate Now for a listing of funds. We look forward to hearing from you and your advisors as you update your estate plan to ensure that your community legacy is intact!