Though often unappreciated, the annual passage of tax season has benefits.

For one, it offers some finality to the prior year in that we finally know if we owe or are due a refund. For example, for the 2021 tax year, the IRS processed 88 million refunds averaging $3,039 each. Simultaneously, filing a 2022 tax return often comes with finalizing quarterly tax estimates for 2023, which many people use to build a framework for current-year spending.

Fortunately, charitable giving ranks high on many “how to use your refund” lists. Whether you have “bonus” money in the form of a refund or gain some peace of mind by knowing your upcoming tax obligations, giving intentionally and strategically always helps that gift go further.

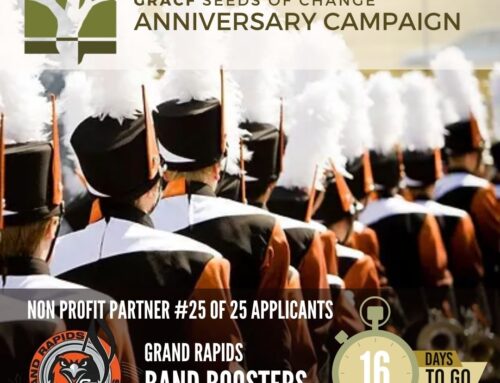

Unfortunately, though, strategic and intentional giving may get lost when gifts to charity are made through a quickly mailed check or an online payment in response to a phone solicitation, television ad, mailer or online advertisement. The Grand Rapids Area Community Foundation (GRACF), however, offers remedies for this!

Lean into intentionality

Many donors give to the same causes annually, with causes tied to faith, health and community ranking high among charitable giving trends. Recently, gifts involving food or home insecurity, natural disasters and international conflicts have become increasingly popular.

Most important is to give to causes that are near and dear to you and for which you can see the ways your giving is contributing to meaningful, positive change in the lives of people in your community. And if you can add to your current list of beneficiary organizations to achieve meaningful impact, all the better.

The Grand Rapids Area Community Foundation can be especially helpful if you have a cause in mind but may not immediately have an organization name or local chapter to support.

Level up your strategy

Now that you’ve identified budget targets for your charitable giving and have a strong sense of the causes you’d like to support, structuring your gift for maximum impact and tax savings should be a top priority.

If you already have a donor-advised fund at the Grand Rapids Area Community Foundation, you know that this vehicle has many benefits, including ready access to our staff; the convenience of jumping online to support favorite causes from your fund; the ability to maximize a gift with accompanying tax benefits; and even the opportunity to schedule a gift to coincide with the occasional matching campaign hosted by a favorite charity. With full tax deductibility in the year of the contribution, donor-advised funds are an ideal way to “mentally offset” current year tax estimates that become known in April. If you don’t yet have a donor-advised fund at the Community Foundation but are considering it, this may be the perfect time to jump in.

With these tips in hand, and with the help of GRACF, you can better plan for the tax year ahead, knowing that causes important to you, whether legacy or new, will benefit from your generosity. For almost 30 years, the Grand Rapids Area Community Foundation has been connecting donors’ charitable intentions to community needs to make our Greater Itasca Area – and the world – a better place to live. For more information, visit our website at www.gracf.org or schedule a visit by calling (218) 999-9100.